W ith the price of Wholesale Energy currently an almost daily news story it’s worth remembering that in September 2021 almost 60% of your energy bill was made up of non-commodity costs.

Some of these non-commodity costs will be itemised as additional charges on your bill but the majority are incorporated rather than hidden into both the unit rate and standing charge you pay, the exact incorporation of which will vary depending on your supplier.

What can I see on my bill?

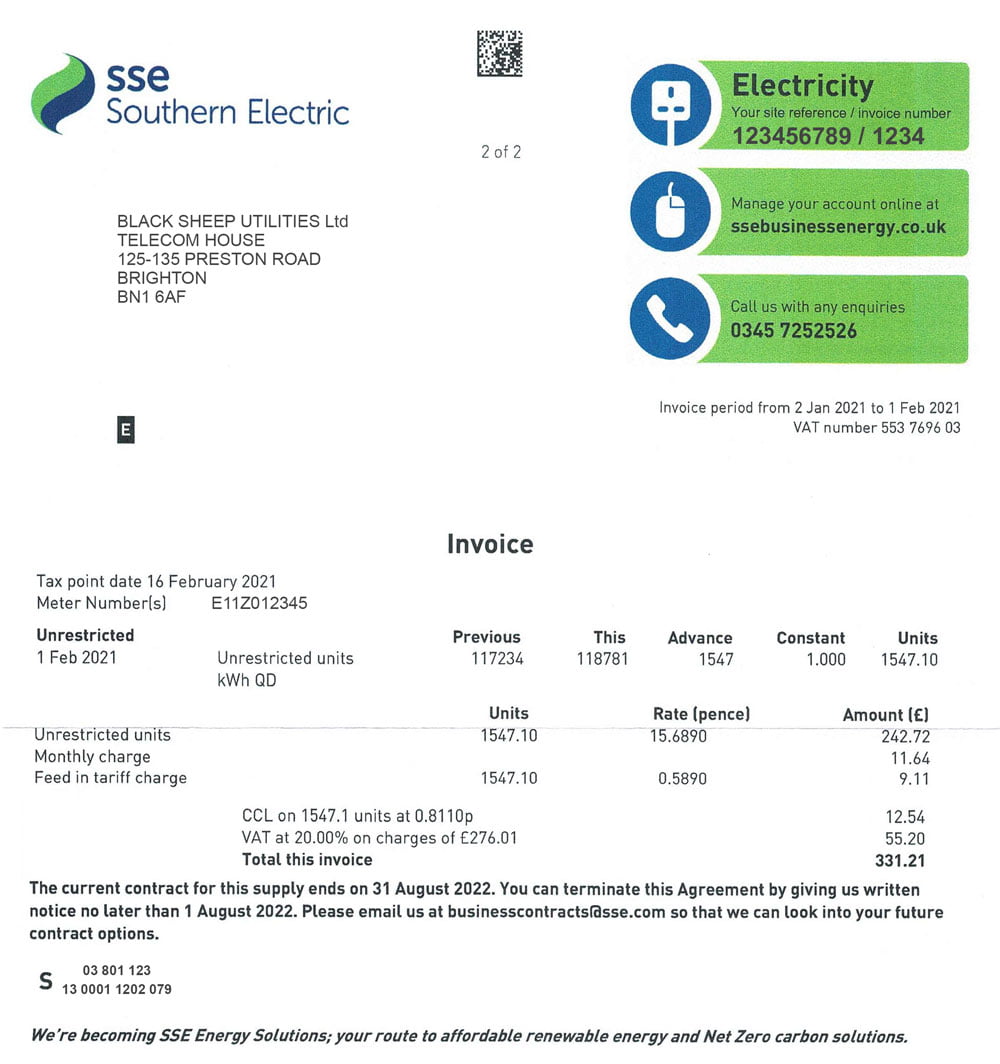

Usually, the only non-commodity cost you will see itemised on your bill will be the Climate Change Levy (CCL) but if you’re an SSE customer, the Feed in Tariff (FiT) will also be itemised.

The only exception to this is for businesses on ‘pass through’ or ‘Raw Power’ contracts which have all non-commodity costs itemised on their bills. Although itemised the actual costs will be forecasted which are then later reconciled.

For the majority of business customers all other non-commodity costs will be wrapped up in your unit rate and standing charge you pay.

Use of System Costs

Delivering energy to customers requires infrastructure and management which are divided into four categories that make up the non-commodity costs you pay.

These are the ‘Transmission Network Use of System’ (TNUoS), the ‘Balance Services Use of System’ (BSUoS), the ‘Distribution Use of System’ (DUoS) and Loss charges.

Renewable Subsidies

Currently, there are three renewable subsidies included in your bill as non-commodity costs – ‘Contract for Difference’ (CFD), ‘Renewable Obligation’ (RO) and ‘Feed-in Tariff’ (FiT).

Taxes and support levies

There are several additional taxes and support levies which are also included in your non-commodity costs. These include the ‘Climate Change Levy’ (CCL), ‘Capacity Market’ (CM) and ‘Assistance for Areas with High Electricity Distribution Costs’ (AAHEDC).

VAT although an additional tax, where applicable, isn’t normally included as a non-commodity cost as it’s a general taxation mechanism.

Catalyst for change

The current energy crisis has seen the wholesale cost of energy soar which has, in turn, resulted in a change to the proportional costs of your energy bills. In September 2021 roughly 60% of bills were made up of non-commodity costs but the recent rise in wholesale energy prices has caused a shift in balance whilst also acting as a catalyst for non-commodity cost increases.

The energy crisis hasn’t just caused an increase in wholesale costs it, combined with other geopolitical factors, as well as climate change promises and obligations has led to a further drive towards self-sustainability which will require massive amounts of investment in infrastructure.

As the industry and government look for funding for this renewable self-sustainability it’s non-commodity costs that will be increased to deliver.

Whatever the future holds for wholesale energy costs, non-commodity costs are set to continue to rise with especially steep increases in the mid to near term.

Want more information about non-commodity costs?

If you’re not sure of the difference between your ‘TNUoS’ and your ‘CCL’, you are not alone. Check out our non-commodity FAQ section below for an overview of each of the different non-commodity costs.

Frequently Asked Questions (FAQ)

What is TNUoS?

TNUoS is the abbreviation used for ‘Transmission Network Use of System Charges’. Electricity needs to be transmitted or transferred from power stations to grid supply points throughout the transmission system. All costs associated with the installation and maintenance of this transmission system throughout the UK, as well as offshore, are recovered through the TNUoS charge.

What is BSUoS?

BSUoS is the abbreviation used for ‘Balance Services Use of System Charges’. These are the costs associated with the day to day running of the transmission system. The integration of renewable energy sources such as wind turbines and solar panels mean that balancing the amount of energy available throughout the system has become more complicated and therefore more expensive to manage and keep operating at the required efficiency.

What is DUoS?

DUoS is the abbreviation used for ‘Distribution Use of System Charges’. Where the UK’s Transmission System (The National Grid) ends the Network Operators infrastructure begins and the DUoS fee is levied directly by the DNOs (Distribution Network Operators) for the development, maintenance and operation of their networks which distribute power from the National Grid to homes and businesses.

What is Fit?

FiT is the abbreviation used for Feed-in Tariff which is a government tariff put in place to increase investment in renewable energy. As a business or household with solar panels you get paid for extra electricity you generate which is paid for through FIT charges paid by other users.

What is RO?

RO is the abbreviation used for ‘Renewables Obligation’, which is a charge introduced by the government to help it to continue to meet its renewable energy targets through infrastructure development.

What is CM?

CM is the abbreviation used for ‘Capacity Market ‘, which is a monthly charge from your supplier based on their share of net demand during periods of high demand. It’s intended purpose is to incentivise further investment in sustainable low carbon electricity capacity from generators and providers who bid in an auction system to receive stable payments for committing to supply energy when required.

What is CfD?

CfD is the abbreviation used for ‘Contracts for Difference’ which was introduced to eventually replace RO (Renewables Obligation). It’s designed as a levy to support renewable energy generation projects such as wind farms on a large scale. CfD certificates are awarded to a selection of these generators which guarantees them a fixed price for electricity exported to the National Grid.

What are Losses?

As it’s naming suggests is the charge created to cover the cost of the loss of electricity that occurs as it travels throughout both the National Grid and the systems operated by DNO’s. Losses are divided into two categories. Transmission Losses – Those that are incurred through the National Grid & Transmission network and Distribution Losses – Those that are incurred on the connecting networks operated by DNO’s

What is CCL?

CCL is the abbreviation used for ‘Climate Change Levy’, which is designed to incentivise overall energy consumption by non-domestic gas and electricity users. There are separate CCL rates for both Gas and Electricity which are kept in constant review.

What is AAHEDC?

AAHEDC is the abbreviation used for ‘Assistance for Areas with High Electricity Distribution Costs’. Introduced in the Energy Act 2004 it’s a fee that is charged to provide additional assistance in the North of Scotland to the relevant DNO’s and therefore allows the distribution charges passed onto customers to be reduced in these areas.