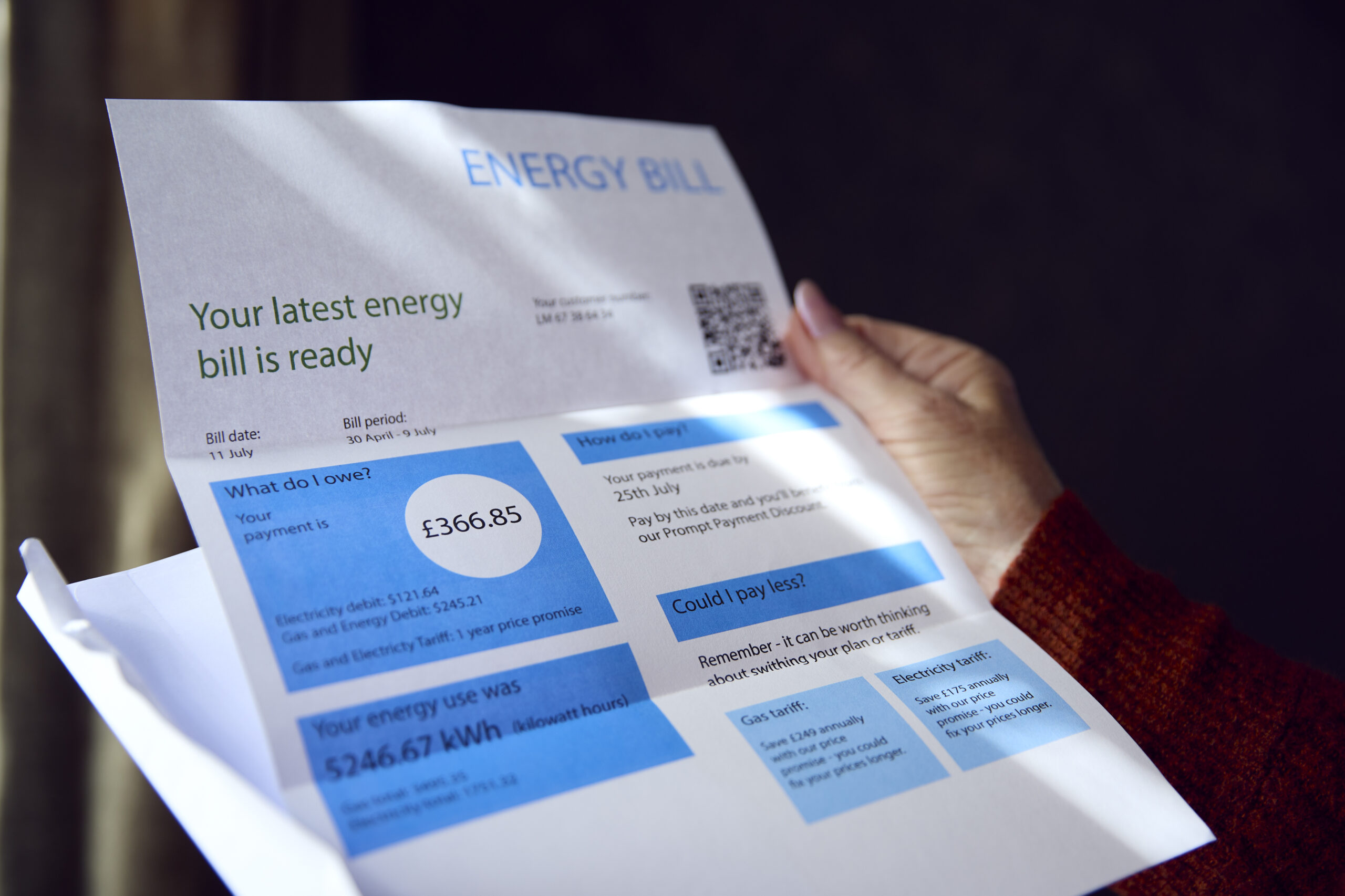

Price Cap Forecasts Signal Renewed Pressure on Energy Markets

Predictions from major suppliers—British Gas, EDF, and E.ON—now suggest the Energy Price Cap is likely to rise by 2–3% in October, reversing last week’s flat outlook. While this cap applies to domestic households, it reflects a sharp turn in wholesale market sentiment—and that matters just as much to commercial buyers.

These shifts in supplier forecasts come as a reminder that wholesale prices remain volatile. Although recent months have offered opportunities to secure lower-cost contracts, the market is changing quickly.

If your business hasn’t reviewed its energy strategy recently, now may be the time to act before rates rise further.

What’s Driving the Shift in Price Forecasts?

The recent forecast increases are being driven by rising wholesale energy costs—particularly gas—which are being affected by:

-

Geopolitical instability, especially renewed conflict in the Middle East

-

Tightening global supply chains, increasing pressure on LNG flows

-

Market speculation as we move deeper into the October Price Cap assessment period

These factors have reversed the downward trend seen earlier this year and introduced greater uncertainty into winter pricing. While long-term predictions remain speculative, short-term market movement is already prompting suppliers to adjust their pricing expectations.

Why Businesses Need to Act Now

Many businesses had been waiting for wholesale prices to stabilise—or even fall further. But with supplier forecasts now turning upward, hesitation could lead to higher costs down the line.

Now is the time to:

-

Secure a competitive fixed-rate contract before prices climb

-

Lock in energy budget certainty ahead of winter

-

Shield your business from further market volatility

Take Advantage with Black Sheep Utilities

Navigating the energy market can be complex—but you don’t have to do it alone.

At Black Sheep Utilities, we specialise in helping businesses make smart, strategic energy decisions. Whether you’re managing a single site or a multi-location operation, we’ll:

-

Analyse your energy usage and goals

-

Review your current contract

-

Identify the best available rates in today’s market

-

Handle negotiations with suppliers on your behalf

Even if your current contract isn’t due for renewal, we can still help you plan ahead,

Take Control While the Window’s Open

Energy prices are currently subject to increased volitility. Make sure your business is ready—not just for today’s market, but for what comes next.

Book a no-obligation energy review with Black Sheep Utilities.

We’ll assess your current position and help you secure a contract that protects your business from future volatility.

GET IN CONTACT WITH US

Will the Energy Price Cap increase affect my business?

While the cap applies to households, forecasts from major suppliers reflect wholesale trends that directly influence commercial rates. A predicted rise of 2–3% in October suggests higher contract rates could follow.

Why are energy prices starting to rise again?

A mix of geopolitical tension, supply constraints, and rising demand is pushing wholesale prices up—causing suppliers to revise their forecasts upward.

Is it risky to wait for prices to fall again?

Yes. The market remains highly volatile. Waiting too long could leave you exposed to higher contract costs if forecasts continue to rise into winter.

How can Black Sheep Utilities help my business act quickly?

We monitor the market daily and use our buying power to find you the best rates available. Whether you’re renewing or switching, we’ll help you stay ahead of rising prices.

What steps should I take now to secure the best energy deal for my business?

Get in touch with Black Sheep Utilities for a quick review of your current energy setup. We’ll advise on the best route forward based on your usage, contract, and the latest market trends.